FortFS Overview

In the brokerage service for a decade, FortFS offers a fortress of trading conditions capped by advantageous client promotions, zero-commissions trading, and zero-margin trading. It also has solid platform offerings and award-winning trading services. However, FortFS lacks decent regulatory recognition.

FortFS Background & Safety

Dubbing itself as “Citadel of Trading”, FortFS was introduced by international financial holding One Vector Group Inc. as TradeFort in 2010 with the mission to provide world-class brokerage services in Forex, CFD, and futures markets to several parts of the world including in Europe, Middle East, Asia, Russia, Latin America, and the CIS.

In the following years, the company focused on providing innovative trading solutions, selecting and improving its accepted payment systems, clearinghouses, and liquidity providers and banks. In 2014, along with its attainment of an international brokerage license, Tradefort was rebranded and reintroduced as Fort Financial Services.

In the same year, the broker won Masterforex-V Trading Academy’s recognition as “The Most Technologically Advanced Broker of 2014”, after catapulting unique trading solutions and features including automatic Call Margin notifications, large volume orders’ slippage decreasing algorithm, and free VPS service. The winning tradition continued for FortFS in the next couple of years, capturing some other international awards and distinctions including Best Forex Broker Asia and Most Transparent Broker in 2015 and Best ECN/STP Forex Broker 2016.

The broker’s last trading services upgrade, at least according to its company timeline posted on its official site, was in 2017 as it launched cryptocurrency trading on its basketful of assets. Surprisingly, the company had no other added features after it.

Despite having international recognitions and ten strong years in the brokerage scene, FortFS remains to be an offshore broker, licensed and registered in Saint Vincent and the Grenadines as an International Business Company and having no official regulatory credential.

FortFS Features & Fees

Market Coverage

In terms of market coverage, FortFS has an ample selection of asset classes including forex (140 classic and exotic pairs), stocks (including USA Blue Chips), cryptocurrencies, commodity futures, and ETFs.

Account Types

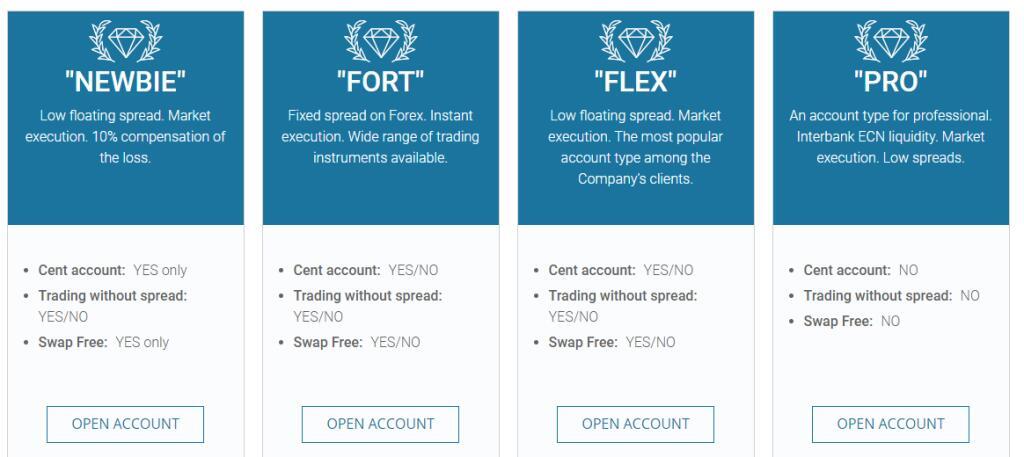

As seen in the above reference, FortFS offers four trading account types in Newbie, Fort, Flex, and Pro.

The account names suggest the type of trader the particular account is best designed for. The first three account types are known as Cent accounts, requiring a $5 minimum initial deposit amount. Also, these three account types can be traded with or without spreads. Meanwhile, the Pro account requires a $500 minimum initial deposit.

Among the four accounts, the Pro account flaunts the best spreads, featuring floating spreads starting from 0.1 pips. Fort is the least with fixed spreads starting from 2 pips. In terms of execution speed, Pro is also ahead starting from 0.1 seconds, while the rest start from 0.3 seconds.

For commissions, the first three accounts have zero commissions for forex trading while the Pro account has a $9 fee. CFD trading has a $10 fee for the three accounts while Pro holds the same fee.

The Newbie and Pro accounts are not eligible for deposit bonuses and dividends while Fort and Flex account users can enjoy from 10-50% deposit bonus and 5% dividend for USD/EUR pair and 3% for USD/EUR cents.

Funding Methods

The broker accepts several funding methods to its customers, with the availability of certain methods depending on the client’s country of residence. Some of the ways to deposit include WebMoney PerfectMoney, Skrill, Kiwi, Neteller, Visa, Mastercard, and Fasapay.

E-wallet payments including WebMoney and PerfectMoney charge deposit fees at 2% and 1% respectively.

The same options are available for withdrawing funds with the same transaction charges.

Promotions

Having market-leading promotions, FortFS offers Welcome Bonus (35 USD) to clients to experience real market conditions without any financial loss. The broker also awards the Deposit Bonus (200%) to every client. It also has MEGAPROTECT Bonus that guarantees to protect client funds during drawdowns and gives an additional 100% to the deposit. Other bonuses include Unlimited Leverage and Autorebate.

FortFS Trading Platforms & Tools

A good selection of modern and standard platform offerings await FortFS clients. The MetaTraders in MT4 and MT5 are lined up with NinjaTrader and CQG Trader.

To help you decide on which platform to use, let us compare the four platform offerings of FortFS in several aspects.

COSTING – MT4, MT5, and Ninja Trader are all free trading platforms; CQG has monthly costs depending on version: CQG QTrader cost $400, Integrated client pays $595; WebTrader and CQG mobile versions are free of charge.

Trading Contracts – MetaTraders provides forex trading; NinjaTrader has futures; CQG has futures or options

Minimum Deposit – $5 for MetaTraders; $10,000 for NinjaTrader; $15,000 for CQG Trader

Mobile Trading – MetaTraders and CQG Trader

Micro-lot account – MetaTraders

The common features among the four platforms include chart trading, advanced testing, Indicators and Expert Advisors, and Auto-Trading.

Bottom Line

FortFS has fortified its client promotions and platform offerings. These two aspects of brokerage service are the advantage of the broker. However, clients looking for a safe broker might doubt FortFS’ legitimacy as it has yet to secure a regulation certification from a known financial institution. Moreover, the broker has to widen its selection of financial instruments to attract more traders.