forex scalping strategy: Forex Scalping Strategy: Best Indicators & Tips

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. How does the scalper know when to take profits or cut losses? When scalping, traders should focus on one currency pair or position at a time to give them a better chance of success. When trading multiple positions at the same time, it can be difficult to properly monitor the technical charts and focus is more often lost.

In addition to general risk management rules about the volume of open positions, there is one more rule concerning scalping. You should not enter trades for the two rising currency pairs at the same time. Although it can double your profit, it also doubles your potential risks, as both pairs may reverse at the same time. This article will discuss some of the best forex scalping strategies based on popular indicators traders use to find high probability setups to scalp on the 1-, 5- and 15-minute timeframes. Scalping the forex market remains a very attractive style of trading, and most novice traders have likely heard of this method at some point or have even tried it for themselves. Considering the small profits that scalpers aim for by executing multiple trades a day, the margin for error is very small and requires a proven scalping strategy.

Wait for price to pull back toward the 25 or 50-period SMA lines, and the Stochastic Oscillator lines need to be below the horizontal 20 level . Apply two Simple Moving Average indicators with different periods of 25 and 50. Please try again later or contact We apologize for the inconvenience. Determining the best forex platform is largely subjective.

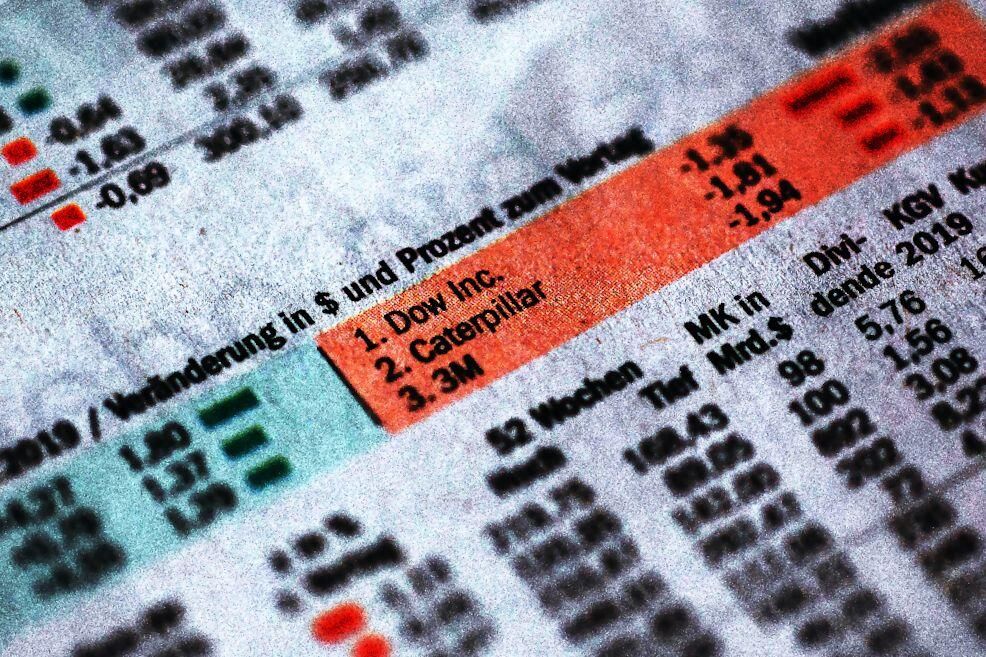

Latest market news

Scalping stock is a scalp Forex trading day strategy. It implies buying stocks and selling them in a short time to make small profits that will cover commissions and margin. How long will a trade be open depends on the stock’s volatility and margin/spread. On average, trades are opened from 3-5 minutes to minutes.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. With this strategy, scalp trading on a 15-minute timeframe will generally require larger stop losses because of the higher timeframe. What is important to note here is that a scalper should calculate the distance from the intended entry level to the middle line, or lower Bollinger band, before an entry is taken.

I recommend using it in ECN accounts with raw spreads. The first step you’ll need to take when looking for momentum trades is to establish the overall trend of the market. Scaping forex can be highly profitable; but it requires a lot of time, dedication and patience. When the profit margins are so tight on each trade, a single mistake can wipe out the gains from several winning trades, so risk management and discipline are essential to your success. Our final 15-minute scalping strategy example uses the Moving Average Convergence Divergence indicator to derive entry signals. With this simple strategy, a trader can decide to exit their position as soon as price hits the middle simple moving average line or when it reaches the lower Bollinger band.

Trading Station Mobile

For the scalping method of trading, order execution is paramount. Scalpers need to have their orders routed, matched and filled as efficiently as possible. Thus, quality execution is fast and without slippage. In scalping, it’s imperative that the broker offers premium order placement and execution. Trade your opinion of the world’s largest markets with low spreads and enhanced execution.

A trader is literally trying to “scalp” lots of small profits from a huge number of trades throughout the day. Scalpers enter and exit trades quickly, usually within seconds, placing large trades in the hopes of profiting from small price changes. Yes, scalping involves short-term trading and is completely legal and allowed by exchanges and brokerages. Scalpers often have a specific temperament or personality that reflects the risky method of trading. Scalping requires concentration, analytical skills and a decent amount of patience, allowing scalpers to make hasty decisions with the hope of making a profit.

It corresponds to 10 USD for a 0.1 lot trade with a spread of 1 point. If a loss turns up, close the trade immediately. Then open a trade in an opposite direction or take a pause. Holding time is up to 30 minutes, the time frame is M15. Alternatively, you can practise scalping with a free FOREX.com demo. You’ll be able to trade our full range of markets using virtual funds, to see how scalping works without risking any real capital.

Determine your entry and exit points depending on whether you think the price will rise or fall. Most of our traders analyse the market on a regular basis for upcoming events that may have an effect on their spread. There are strategies inappropriate to an asset or market conditions. In scalping, just a second sometimes matters, and a delay may result in a loss that may exceed a small profit. Even if you set your profit target at three points, wait for the trend to complete its movement.

It is quite hard to make money by utilizing such a strategy. Both methods have their own advantages and drawbacks. If you deviate from your plan and let a loss run, the profit from your day could be wiped out instantly. Once the above conditions are met, enter a long position as soon as the Stochastic Oscillator lines cross above the horizontal 20-level line.

What Is The Difference Between Trading And Investing?

It is glitch-free and promotes precision as data is transferred seamlessly to and from the market. Has traded in a tight consolidation pattern on a 30-minute time frame. As a result, Sam the scalper has decided that a bullish or bearish breakout may be in the offing. Scalpers can place up to a few hundred trades in a single day, seeking small profits. Its name is derived from the way its goals are achieved.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Gold is less liquid than currency pairs, so its spread is bigger. Thus, 1-5 minute trades can be opened only during periods of local fundamental volatility, which happens rarely. However, 30 minutes are often enough for small profits.

We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. As each trade carries transaction costs, scalping can result in more costs than profits. The assumption is that price will complete the first stage of a movement in a short span of time so you aim to take advantage of market volatility. Because scalpers basically have to be glued to the charts, it is best suited for those who can spend several hours of undivided attention on their trading.

Emotional stress, you have to be constantly focused on small things. You have to monitor your trades all the time and make your decisions quickly. Sooner or later, a scalper feels emotional exhaustion, loses focus. The problem can be partially solved by scripts and trading robots.

Our review Ichimoku Cloud Indicator in Forex Explained deals with this indicator in detail. I use only one of its signals — the Tenkan-Kijun cross — in this Forex scalping strategy. Best Forex scalping strategy does not imply carrying positions over to the next trading day and thus excludes swap expenses.